How to prepare your business for Making Tax Digital

By BizBritain

By BizBritain

almost 7 years ago

read

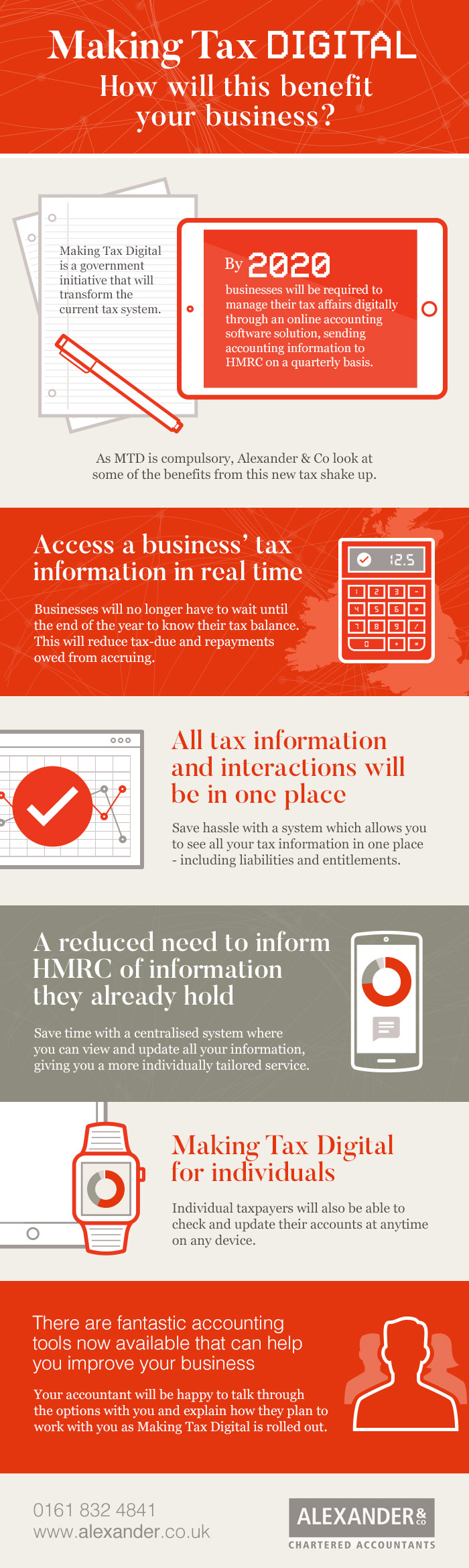

Making Tax Digital aims to make it easier for businesses and individuals to organise and manage their tax affairs. Moving tax to a digital platform will enable businesses to simply log on and check important tax information, saving time and money.

The annual tax return has been a regular occurrence for those who are either self-employed or own their own company. These new changes will eradicate the need for an annual tax return and also help businesses better calculate their tax, which in turn, will help them save money on their tax payments.

Many businesses have already started keeping digital records, however more businesses will have to make the switch, as the government plan to make all tax digital by the year 2020. Manchester-based accountants, Alexander & Co take a look how businesses can prepare for this change to Making Tax Digital, in order to make the transition smoother.

Speak to your accountant

Ask your accountant about keeping digital records. You may find that it is something they are planning to put into place, however discussing it now will ensure you have everything you need when the switch is put into place.

Your accountant will be able to give you the full rundown on how you need to get your business prepared and what they’ll need from you going forward. Your accountant will be the first to know what the HMRC will require from you. They will be working closely with the government during the implementation, to make sure you deliver all of the required documents.

What processes can you put into place to make things smoother?

Now is the perfect time to start keeping digital records and accounts. Speak to your accountant about starting to move to digital record keeping, or, if you manage your own accounts, research into software that could make things a little easier.

Start to keep digital records on your company and its finances as soon as possible. You’ll be required to provide information on:

- Directors, shareholders and secretaries

- Shareholder voting results

- Loan repayment deadlines and agreements

- Indemnities

- Transactions when shares are bought in the company

- Loans and mortgages against the company’s assets

This information as well as your accounting records, will need to be provided when handling any tax affairs digitally.

What will you need to do in order to set up digital tax?

As per above, you will need all information about your company and your accounting records, whether that is supplied by your accountant or collated yourself.

If you use an accountant for your business, they will be able to sort out the move to digital tax, so you don’t have to worry about collecting all the information yourself. However, they may suggest ways you can start to keep digital records, including receipts, expenses etc.

If you are a freelancer, self-employed or an SME that deals with your accountants yourself, investing in digital accounting software is something you should consider within the next year. You will then be able to easily export the data and send it straight to HMRC.

Making Tax Digital will be put into place by 2020, so it is a good idea to start looking into digital record keeping, sooner rather than later. Alexander & Co have put together the infographic below, to help further explain what the switch to Making Tax Digital will entail and how it will benefit your business.

.jpg)

.jpg)