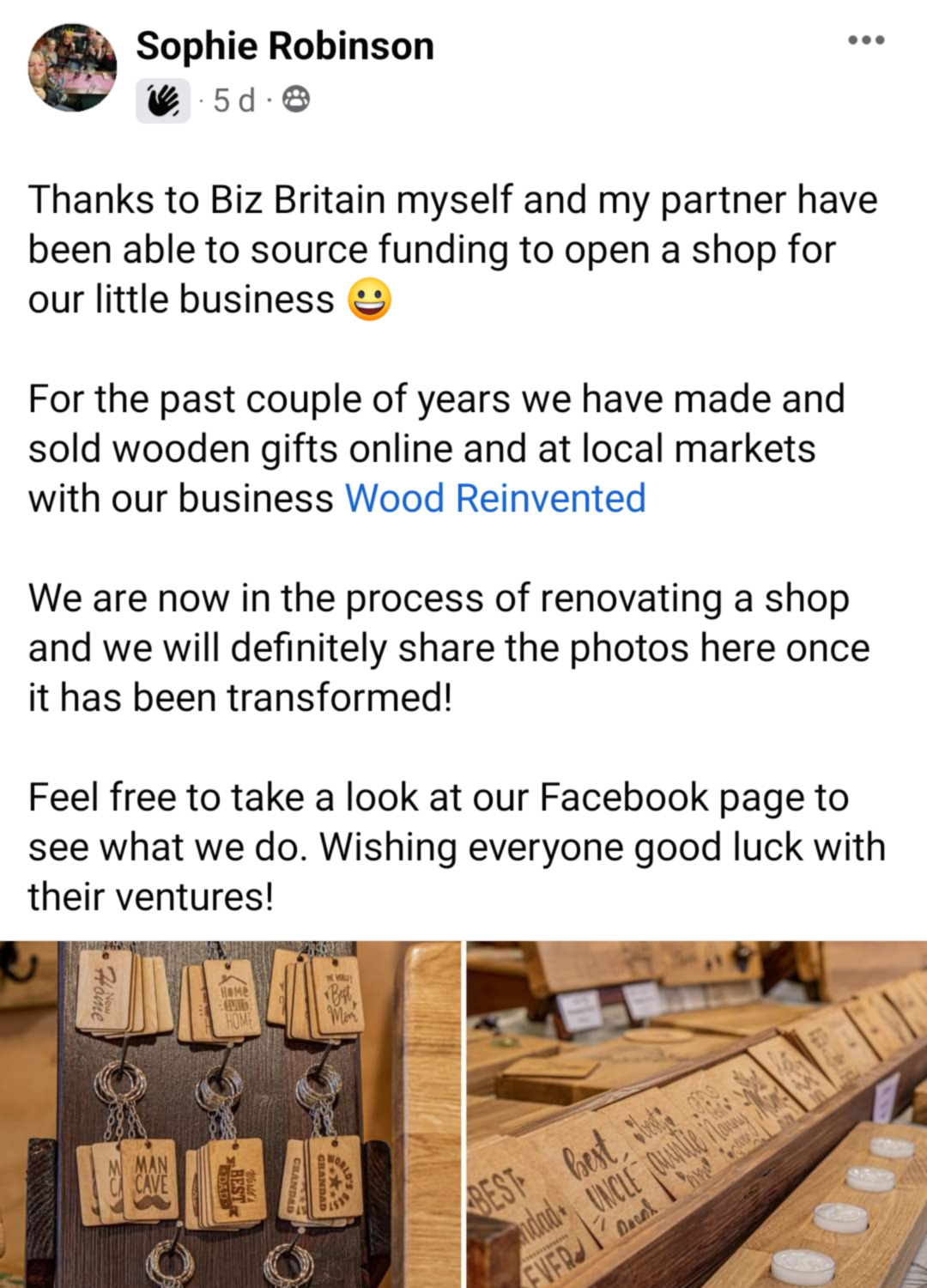

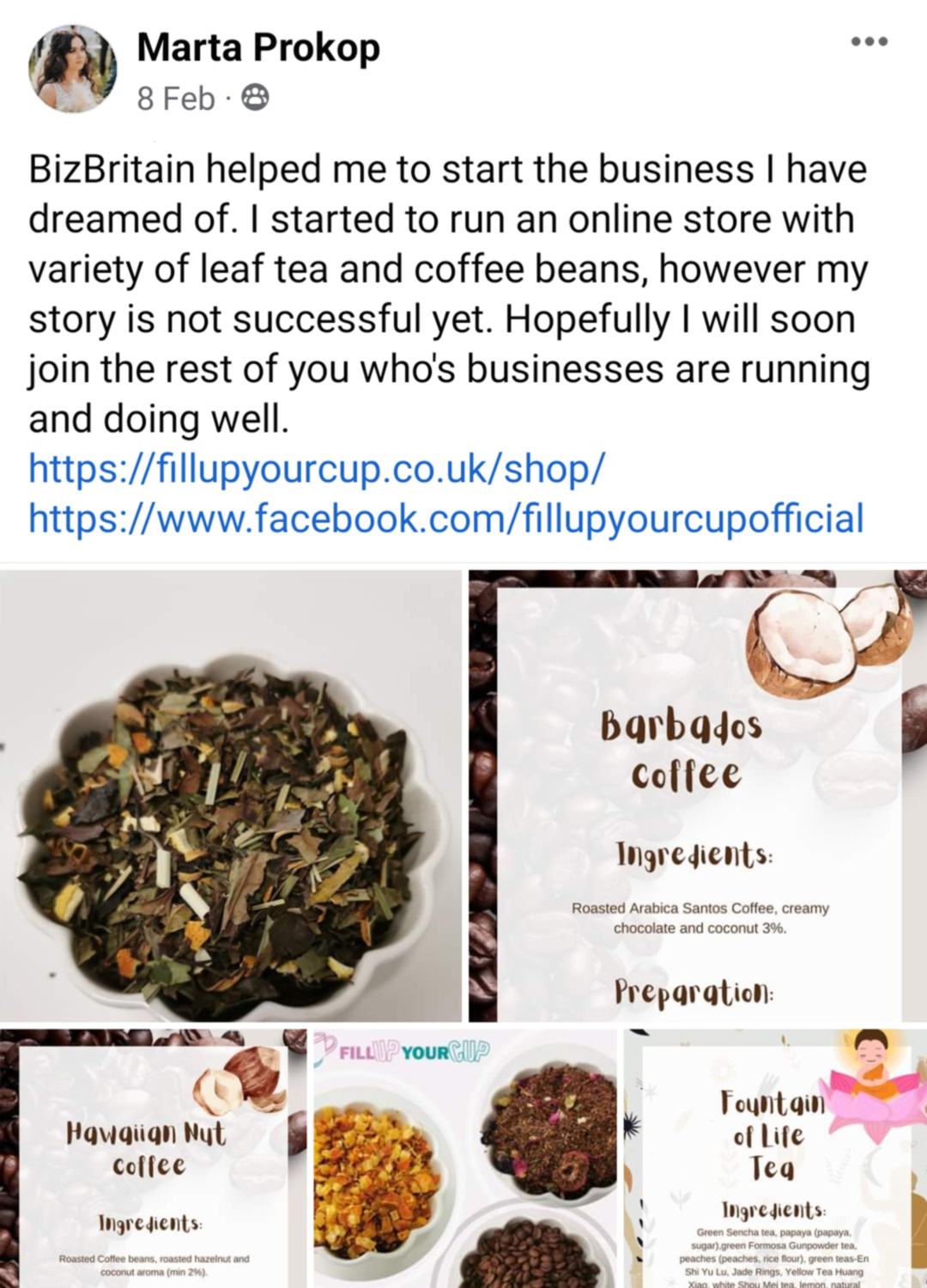

GET A START UP LOAN OF UP TO £25,000 AND UNLOCK YOUR FULL POTENTIAL

With Start Up Loans ranging from £500 to £25,000, BizBritain has your back. Whether you’re just starting out or have been trading for up to three years, a Start Up Loan could provide the capital needed to start & grow your business.

We’re a credit broker not a lender *

Apply FOR A START UP LOANBorrow

for

*The calculator is for illustrative purposes only.

£120M+

MONEY LENT

10k

ENTREPRENEURS

4

UK NATIONS